SCAMS

Common SCAMS

And How To Protect Yourself From Them

Criminals and con artists use many schemes and techniques (known as scams) to target unsuspecting people to get access to their money and personal identifiable information. Consumer scams happen on the phone, through the mail, e-mail, or over the internet. They can occur in person, at home, or at a business. R.O.S.E. will show you several steps you can take to protect yourself, your money, and others from fraud and scams.

A few of the ways to protect yourself and your money:

- Be aware of your emotions.

- Talk to a trusted person before acting.

- Verify before trusting.

- If you are writing checks, use a gel ink pen.

- Government offices (e.g. IRS and Social Security) will not unexpectantly call you.

- Keep your personal information confidential including your multi factor authentication code, usernames, and passwords.

- Share what you learn with your family and friends.

There are so many different types of scams and scammers are constantly coming up with new scams and techniques. We created the Anatomy of a Scam so you will have a better understanding of scams in general and be better able to recognize a scam. To learn how R.O.S.E. can help you, click HERE to contact us.

To Report a Scam:

Consumer Fraud and Identity Theft

Or Call the FTC Consumer Response Center at

1-877-FTC-HELP (382-4357)

Health Care Fraud, Medicare/Medicaid Fraud, & Related Matters

Or Call Health & Human Services At

1-800-HHS-TIPS (447-8477)

Common Frauds Commonly Affecting Over 60 Individuals

from the 2023 IC3 Elder Fraud Report

Call Center Fraud

Tech and Customer Support/Government Impersonations – complainants over the age of 60 lost more to these scams than all other age groups combined. This age population reportedly remortgaged/foreclosed homes, emptied retirement accounts, and borrowed from family and friends to cover losses in these scams. Some incidents have resulted in suicide because of shame or loss of sustainable income.

Investment Scams

Investment Scams include complex financial crimes often characterized as low-risk investments with guaranteed returns including advanced fee frauds, Ponzi schemes, pyramid schemes, market manipulation fraud, real estate investing, and trust-based investing such as cryptocurrency investment scams. Most cryptocurrency investment scams are socially engineered and trust-enabled, usually initiating through a romance or confidence scam, and evolving into cryptocurrency investment scam.

Confidence/Romance Scams

Confidence/Romance scams occur when a criminal adopts a fake online identity to gain an individual’s affection or confidence. The scammer uses the illusion of a romantic or close relationship to manipulate and/or steal from an individual. They gain trust and eventually will ask for money.

Grandparent Scams

Grandparent scams occur when a scammer impersonates a panicked loved one, usually a grandchild, nephew, or niece of an older person, and claims to be in trouble and needs money immediately.

Cryptocurrency Scams

The largest losses among complainants over the age of 60 are from cryptocurrency investment scams, which account for approximately 64% of all losses related to cryptocurrency for this age group. Scammers use cryptocurrency ATMs and kiosks as a payment mechanism. Scammers convince individuals to withdraw large sums of cash and deposit into cryptocurrency ATMs or kiosks at locations provided by the scammers.

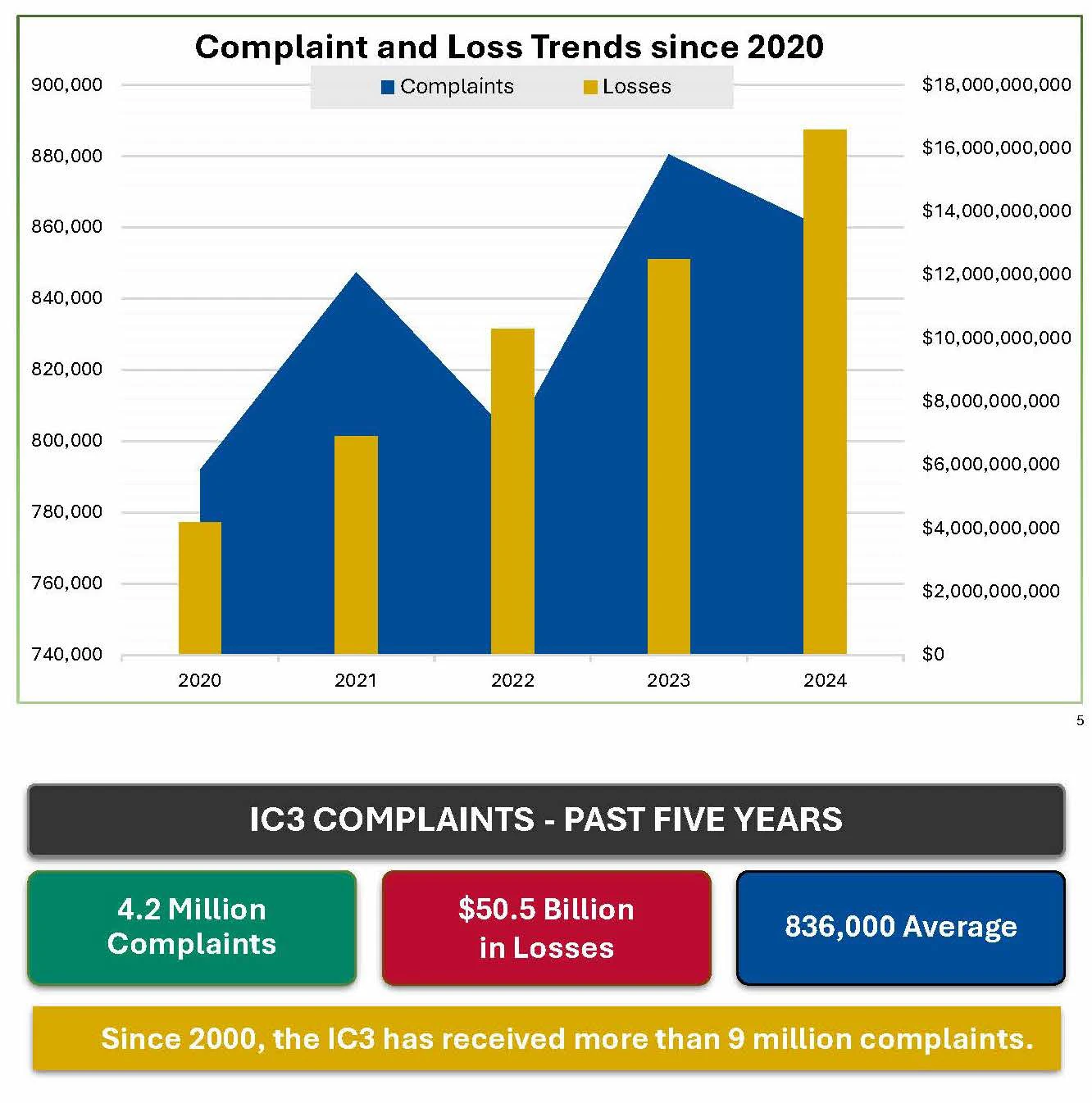

The following report is from the

2024 IC3 Elder Fraud Report

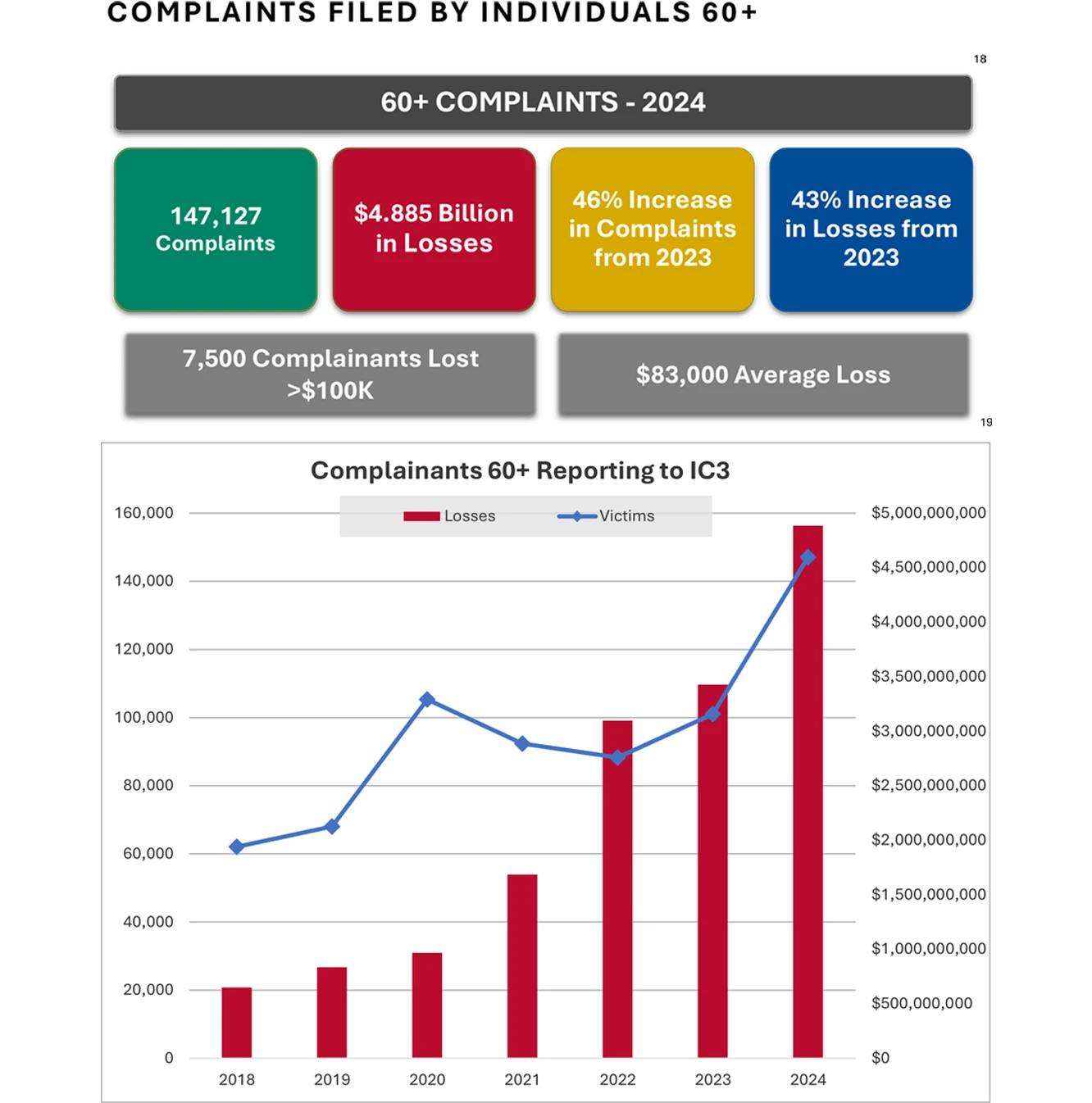

18 Charts describe count and loss trends for those 60+ from 2018 to 2024.

19 Accessibility Description: Chart describes counts and losses for those reporting as 60+ from 2018 to 2024.